Investor-Ready.

Deal-Approved.

Built for Speed.

-

No Personal Income Needed — Ever

-

Zero Asset Seasoning Requirements

-

Credit Score? Not a Barrier

-

Close Lightning-Fast in Just 10 Business Days

Key Benefits

No Credit Score Needed

Simplified approval for more borrowers.

No Income or Asset Verification

Less paperwork, faster closings.

Residential and Commercial Properties

Not a primary or secondary residence; not occupied by the borrower or related party.

Close in as fast as 10 Days

Accelerated timeline after we receive appraisal and title.

Programs We Offer

Fix and Flip

Fix & Flip loans provide fast capital to acquire, renovate, and resell properties for profit. With flexible underwriting and quick draw schedules, investors can stay on track and maximize ROI. It’s the go-to funding solution for scaling your flipping business.

Ground Up Construction

Ground Up Construction loans give investors the capital to build new projects from the ground floor with speed and flexibility. Funding covers land, materials, and construction phases with streamlined draws to keep timelines tight. It’s the ideal solution for developers looking to maximize returns and scale new-build opportunities.

Long Term Buy N Hold

DSCR loans let investors qualify based on a property’s cash flow—not personal income or tax returns. With flexible guidelines and competitive long-term pricing, they’re ideal for building or refinancing rental portfolios. It’s the simplest way to scale consistent, passive-income investment properties.

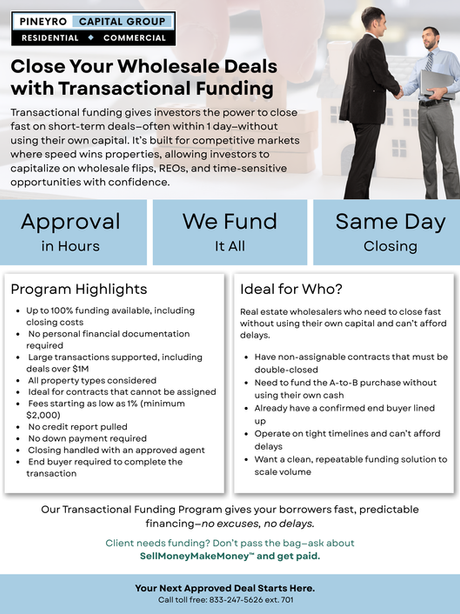

Transactional Funding

Transactional funding gives investors the short-term capital needed to complete same-day or back-to-back closings without using their own cash. It’s fast, flexible, and perfect for wholesalers securing profitable assignments. This structure lets you execute deals confidently while protecting your spread and avoiding funding delays.

Bridge Private Hard Money

Bridge private hard money loans provide fast, asset-based capital to seize opportunities without traditional lending delays. Ideal for acquisitions, repositioning, or time-sensitive deals, these loans offer high leverage and flexible terms. It’s the go-to solution for investors who need speed, certainty, and funding that moves at the pace of the market.

Commercial Real Estate

Commercial real estate loans offer investors flexible capital to acquire, refinance, or reposition income-producing properties across multiple asset classes. With competitive terms and custom structures, these loans support value-add strategies, cash-flow plays, and long-term portfolio growth. It’s the ideal solution for scaling commercial investments with confidence and speed.

Product Overview

Flexible Loan Size

From $75,000.00 - $5M.

Term

From 12 months to 40 Years.

Interest Rate

From 5.99% - up.

Broker Fee

From Zero to 3% of Loan Amount.

How It Works?

Submit Minimal Information

Applicant completes the streamlined pre-approval form online.

Receive Instant Offer

We’ll generate a loan offer quickly based on property details.

Pay Appraisal

Pay property appraisal fee directly to the assigned appraiser / AMC.

Clear Conditions

Clear all conditions required to issue funding confirmation

FUND

Closing takes place usually within 7 days

Why Choose Us?

At PCG Commercial, we offer no doc loans for residential investment property lending, enabling all our referral partners to efficiently serve clients with minimal paperwork and faster approvals. Our transparent, competitive fee structure and advanced technology platform enhance your profitability and client satisfaction, making it easier to grow your business.

Join our Hassle-Free SELLMoneyMAKEMoney™ Partner Program

_edited.png)

Originate License-Free: Business Purpose Programs in States Without Licensing Requirements

Many states do not have licensing requirements, so you’re free to originate Business Purpose Programs in the following states without an active NMLS license:

-

Originate in 40+ states license-free

-

Qualify self-employed investors – NO tax returns

-

Purchase, Rate-&-Term, or Cash-Out

-

Fast 4-hour loan decisions

-

Earn commissions on every closed deal

-

You Refer. We Fund. You Get PAID!